Accounting

Accounting, which is often just called “accounting,” is the process of measuring, processing, and sharing financial and other information about businesses and corporations.What is accounting.

Accounting is the processor keeping the accounting books of the financial transactions of the company. The accountants summarize the transactions in the form of journal entries. These entries are used in bookkeeping. The books of accounts are prepared by the accountants as per the regulation of the auditors and various regulating bodies. The accountants might follow the Generally Accepted Accounting Principles (GAAP) or the IFRS (International Financial Reporting Standards) principles

If an analyst reads the book of accounts, he/she can get a fair idea of the financial situation of the company. Thus, for public listed companies, the book of accounts is necessary to determine the company valuation.

How does accounting work?

Accounting is one of the most important things a business does. A bookkeeper or accountant might do it in a small business or by dozens of people in a large organization’s finance department. The reports made by different types of accounting, like cost accounting, financial accounting and managerial accounting.

The operations, financial status, and cash flows of a large organization over a certain time period are summed up in the financial statements. These are short reports after incorporating all the transactions based on hundreds of individual financial transactions. So, on top of years of schooling and hard tests, all accounting credentials require a certain number of years of real-world accounting experience.

In the United States, a bookkeeper can handle simple accounting tasks. In contrast, other qualifications like the CMA or the CPA might be required for complex tasks. In Canada, the CPA manages complex tasks.

In India, the CA or the Chartered Account is the qualification for the accountants. It is a competitive exam, and the student needs to pass the papers to become a chartered accountant. For all tax-related and accounting related queries, the CA is considered a knowledgeable person.

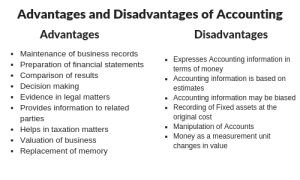

- Maintenance of business records.

- Preparation of financial statements.

- Comparison of results.

- Decision making.

- Evidence in legal matters.

- Provides information to related parties.

- Helps in taxation matters.

- Valuation of business.

-

Disadvantages of Accounting

- Expresses Accounting information in terms of money.

- Accounting information is based on estimates.

- Accounting information may be biased.

- Recording of Fixed assets at the original cost.

- Manipulation of Accounts.

- Money as a measurement unit changes in value.